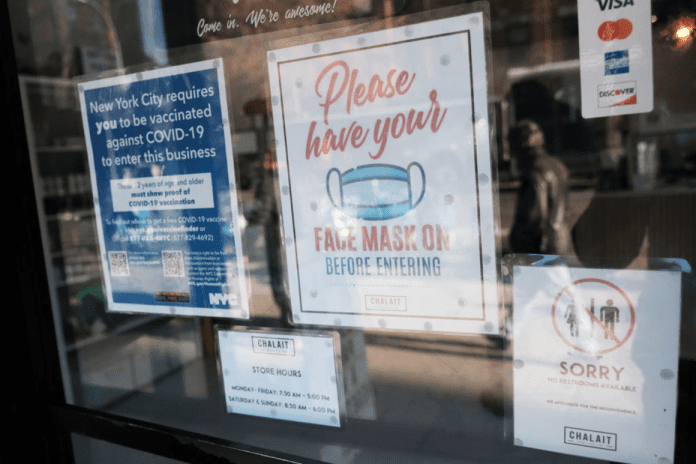

The Omicron surge is forcing pandemic-battered businesses to once again scale back and close their doors, energizing a lobbying push for billions of dollars of new aid for struggling employers and their workers.

The question Congress will face when it returns in January is whether the latest Covid-19 wave justifies a new rescue beyond the $1 trillion of emergency small business assistance lawmakers have approved since March 2020. Most of the programs have been tapped out or are winding down. The giant Paycheck Protection Program stopped accepting applications for aid in May, and the Covid Economic Injury Disaster Loan program closes to applicants this month.

Groups representing restaurants, gyms and other businesses have been warning for months that their members still need help because the earlier programs didn’t meet their needs and economic headwinds have persisted, including rising costs and staffing shortages. They believe Omicron could be a wake-up call for Congress and lobbyists see a window of opportunity now that President Joe Biden’s social spending and climate plan is in limbo.

“If Congress finds it cannot focus on the Build Back Better Act, that creates an opening for them to look a little more local to their districts,” said Sean Kennedy, the National Restaurant Association’s executive vice president for public affairs.

The outcry poses a new challenge for the Biden administration and congressional leadership heading into the 2022 midterm elections. While the earlier small business rescue was one of the most broadly bipartisan pieces of Congress’s Covid response, recent attempts to replenish relief programs have failed to gain traction.

“Instead of lifting all boats, we’ve only lifted some, leaving scores of small business owners out in the cold through no fault of their own,” more than 60 House members said in a bipartisan letter to Hill leaders on Dec. 17. “Many of these small business owners have taken on extraordinary debt while they wait for much-needed federal assistance. We must help them before it is too late.”

The Biden administration has yet to join the push as part of its response to Omicron.

“Of course, we will continue to closely monitor the economic recovery and follow closely whether future developments would require some targeted resources, but these would need congressional action and buy-in,” said White House spokesperson Emilie Simons.

The new push for aid faces several potential political challenges.

Omicron so far has not triggered widespread lockdowns to impose social distancing. And while a number of Republicans are championing the relief effort, some are likely to resist further federal spending — thanks in part to the emergence of billions of dollars of potential fraud in earlier programs.

It would likely be aimed at specific industries if it gained traction, unlike the Paycheck Protection Program, which made forgivable loans available to a wide range of sectors.

The small business lobbying coalition has splintered around the issue, with key groups such as the International Franchise Association instead focusing their efforts on the labor shortage and the vaccine mandate.

“Everyone’s waiting to see what Omicron does or leads to,” said Kevin Kuhlman, vice president of federal government relations at the National Federation of Independent Business. “A month from now may look very different.”

U.S. Census Bureau data indicates that many employers were already struggling just as Omicron hit. A survey conducted Dec. 13 through Dec. 19 found that 36 percent of businesses already believed it would take more than six months to return to normal operations, with 12 percent not expecting normalcy to ever return. About 45 percent had domestic supplier delays while 31 percent had difficulties hiring. Nearly 24 percent experienced a decline in revenues over the last week.

The latest Omicron surge is adding to business owners’ woes, with restaurants in particular suffering an uptick in voluntary closures and resorting to limited service as cases surge during the critical holiday season. About 90,000 restaurants have closed long-term or permanently during the pandemic, according to the National Restaurant Association.

“The holiday season is where they are making the revenue that allows them to survive the lean winter months when outdoor dining isn’t an option and people are doing less vacation travel,” said Kennedy with the restaurant association.

It’s adding new urgency to the restaurant industry’s long-running lobbying campaign to replenish the Small Business Administration’s $28.6 billion Restaurant Revitalization Fund, which saw demand for grants far outstrip available funding by almost $44 billion earlier this year.

“This is going to be the moment where we’ll likely see restaurants that have received Restaurant Revitalization Fund grants have the capacity to navigate this latest crisis in a way that those who didn’t receive that funding do not,” said Erika Polmar, executive director of the Independent Restaurant Coalition.

Gyms are also seeking additional aid. The International Health, Racquet and Sportsclub Association says that almost a quarter of all gyms, health clubs and studios have closed their doors permanently. Liz Clark, the group’s president and CEO, said Omicron could cause more damage.

“Congress kept telling us to wait, but America’s gyms can’t wait anymore,” she said.

Business groups are eyeing legislation being drafted by Senate Small Business Chair Ben Cardin (D-Md.) and Sen. Roger Wicker (R-Miss.) as the most likely vehicle for further assistance.

Sources familiar with discussions around the bill said it is likely to include more funds for restaurant grants and targeted aid for other specific industries, including potentially gyms, minor league baseball teams and border businesses.

Determining which industries are in and out will be a key dynamic determining whether the bill can attract the 60 Senate votes needed to overcome a potential filibuster.

Polmar, with the Independent Restaurant Coalition, said her group plans to use Congress’s holiday break as an opportunity for restaurant owners to make their case to lawmakers while they’re back home in their districts.

“We’re not going to sit quietly,” she said. “Our grassroots advocacy network is over 100,000-strong. They’re more fired up than ever.”