Company: Tenant Property Protection

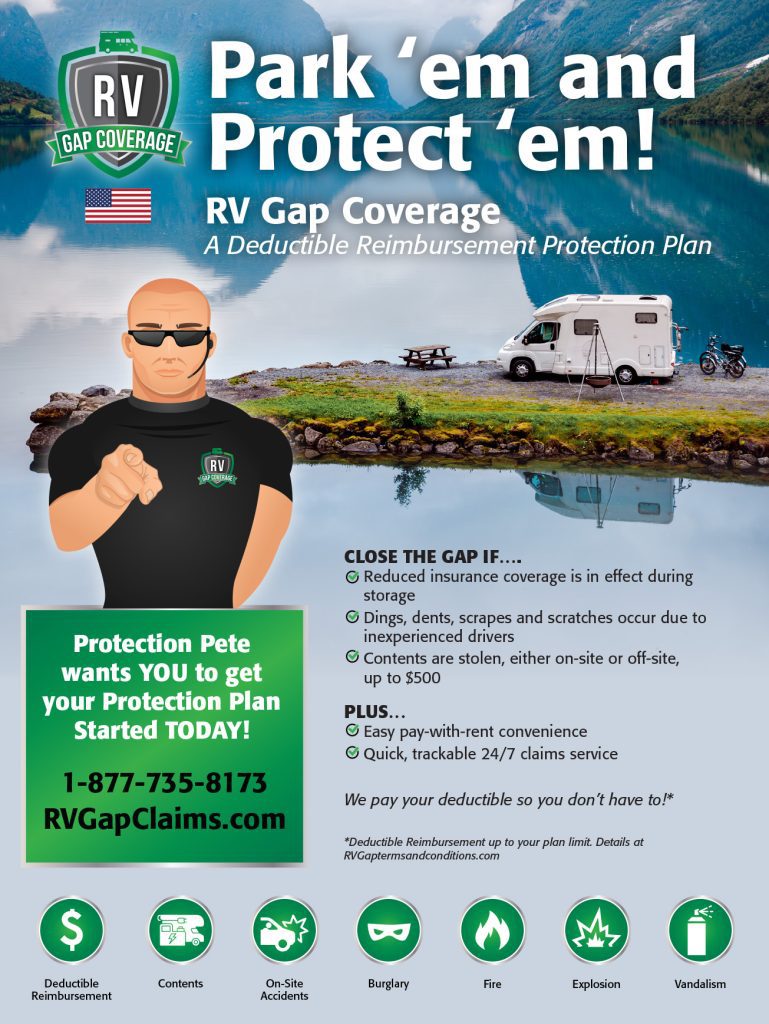

Product: RV Gap Coverage

Location: Phoenix, Arizona

Bridging the GAP for RV Owners and Self-Storage Facilities

Recreational vehicle ownership is raging across America. RVs provide the ultimate luxury for adventurous travelers who like taking their comforts with them during vacations. With areas for cooking, cleaning, showering, sleeping, and storage, the RV is an all-in-one vehicle that people have enjoyed since the early 1900s. The RV industry is attracting new buyers of all generations, from millennials to retirees, who want the freedom to travel in their own space without worrying about the pandemic-related health concerns associated with travel today. Sales are up 40% year over year, showing strong demand for new RV sales.

RV storage owners have a tremendous opportunity to increase their revenue by offering RV Gap Coverage Protection to tenants without competing on lease pricing. Tenant Property Protection (TTP), a 4-year straight winner of the “Best of Business Tenant Protection Program” award, has become the industry first to introduce this specialized program to RV storage owners/operators. For several years, self-storage treated RV and vehicle spaces as a secondary market. Now RV storage spaces are becoming the least expensive space with the most significant revenue potential. TPP claims their RV Gap Coverage is the best in the industry, offering a deductible reimbursement for onsite accidents, unexpected losses, and damages.

TPP claims their RV Gap Coverage is the best in the industry. Their “gap” plan reimburses the traditional out-of-pocket insurance deductibles a tenant incurs for onsite accidents like dings, dents, scrapes and scratches, accidental damage to the facility; up to $500 for theft or content damage onsite and off-site for items not permanently attached to the vehicle like batteries, generators, propane tanks and more and up to $350 for after-market replacement costs for stolen catalytic converter parts. Covered perils include burglary, fire, explosion, and vandalism.

It’s not uncommon for RV owners to take advantage of their “storage” option to reduce their insurance premium, but by doing this, they actually turn off their Collision/Comprehensive Coverage, leaving them vulnerable while storing their vehicle. RV Gap Coverage keeps them protected. RV storage owners work with TTP to bundle the coverage program with their leases and storage rentals. Their top owners make $24,000 to $45,000 extra revenue per year per 500-space facility, making RV Gap plans the 2nd highest revenue generator for storage owners. And if a customer has a claim but is behind on their rent payment, they won’t receive their claim check until they’ve paid you in full for their rent. TTP would love to help you better protect your customers, your managers, and your reputation. It’s all about peace of mind.

TPP’s talented team provides storage owners/operators and managers training, making it easy to implement, sell, and manage the RV Gap Plans. They enroll the tenants, train the staff, and maintain the momentum of a new program via their “Fast Track to Success” process. TTP’s team will use a combination of personal visits or video conferencing tools and their award-winning sales materials, which can have a facility or facilities on board in 30 days or less.

Recently, we received these details in an interview with RV Gap Coverage by Tenant Property Protection staff.

TSN: If we coined a synonym for your protection plan, would it be more akin to a warranty for storage items?

TPP: Not really. A warranty often refers to new products from manufacturers (electronics, jewelry, household items, or tools) purchased and covered for a specified time and coverage limits. Protection plans usually refer to similar coverage on pre-owned items in storage.

We’ve coined our RV Gap Coverage Protection Program as a ‘Deductible Reimbursement’ or ‘Reimbursement Plan.’ The plan can eliminate their traditional out-of-pocket insurance deductible associated with submitting a claim. This means ‘we pay the deductible for the RV owner, so they don’t have to’ for minor onsite accidents, damages, or content theft, thus filling the insurance gap.

TSN: Is there typically a waiting period for coverage?

TPP: No, the coverage for RV Gap begins when the lease is signed and they make their lease payment. Our protection plans are part of the lease agreement. We indemnify (protect) the tenant’s property on behalf of the owner, providing a third-party administration of the program via their lease.

TSN: How do you deal with deprecation? What is your replacement cost plan?

TPP: Deprecation is not a part of our RV Gap Coverage Protection Plan. It’s a Deductible Reimbursement for onsite accidents, so the RV owner has no out-of-pocket expenses involved in submitting a claim.

Let’s compare a ‘depreciation or Actual Cash Value (ACV) – Plan’ with a Replacement Plan using a 2017 boat trailer valued at $1000 at the time of purchase. With the ACV plan, the insurance provider will deduct their $250 deductible and then take away approximately 10% per year from the value of the boat trailer owned. So, that would look like this:

Value of $1000 – $250 deductible = $750 – $400 ($100/each of the 4 years owned). The tenant will receive an insurance claim settlement of $350.

However, with our RV Gap Coverage Protection Plan, our adjusters will look for a boat trailer with the same year, make, and model and replace the trailer. A replacement plan would look like this:

Value of $1000 – $0 deductible = $1000. A replacement boat trailer with the same year, make and model, is found for $700. The tenant will receive a claim settlement of $700.

Therefore, our programs are built on a value proposition which is ‘We care about what you value!’ And that is shown in our best of business, white-glove claim service.

TSN: Your RV Gap Coverage service is aimed explicitly at RV storage. No licensing, fingerprints, or background checks. How did you cut all the red tape out?

TPP: That is our ‘secret sauce!’ Let’s just say we own our entire process. That means we carry all the necessary licenses and compliance requirements internally, as well as handle all the claims on behalf of our owners.

TSN: How does your deductible reimbursement plan work?

TPP: Owners who enroll with us are provided the option of 2 plans ranging from $15 and $20, which offer protection limits of $1000 or $1500. Several unique features make these plans valuable because some RV/Boat insurances do not cover what we cover or even offer ‘storage’ premiums ‘downgrades’ that those owners ‘take advantage of.’ By doing this, it eliminates their Collision/Comprehensive Coverage to liability-only while in storage. By removing their Collision/Comprehensive Coverage, they’ve removed protection against those minor onsite accidents and contents coverage for stolen/damaged items onsite or off-site.

TSN: How popular are your services among self-storage owners? Do they typically sell out?

TPP: Both RV and Self-Storage owners with mixed secure units and vehicle storage spaces (indoors or outdoors) have found RV Gap Coverage Protection Programs to be the #2 revenue generator over selling ancillary products such as locks and boxes. So, we see owners work with us to ‘bundle’ our program to 100% of their tenant occupants or create a 60-70% penetration with our sales and marketing tools, training, and servicing.”

TSN: How much can customers earn through your plan?

TPP: Our best owners are making $24,000 to $45,000 extra revenue per year per 500-space facility.

TSN: Would you say the demand for RV storage is reaching all-time highs?

TPP: RVs and their owners are the ‘New Asset Class’ of storage. This segment has multiplied and is a higher value vertical than the ‘old mattresses, boxes, and stuff’ self-storage unit ownership. And due to HOA’s, environmental concerns, and the need for these particular assets storage space, this industry is attracting Millennials to retirees who want the freedom to travel in their own space without worrying about the issues brought on by the pandemic.”

TSN: What type of business training do you offer them to maximize their sales?

TPP: Our talented team provides an ‘easy to implement, easy to sell, and easy to manage’ process for the self-storage owner/operators and managers. We can enroll the tenants, train the staff, and maintain the momentum of a new program via our ‘Fast Start’ process. Our team will use a combination of personal visits and video conferencing tools combined with our award-winning sales materials, which can have a facility or facilities on board in 30 days or less.

TSN: What’s the hype around your new to market RV Gap Coverage service? What makes it unique in today’s market?

TPP: Tenant Property Protection, a 4-year straight winner of the Best of Business Tenant Protection Program award, has become the industry first to introduce this specialized program to RV storage owners/operators. Do you remember your first boyfriend? First car? Being first has its memorable advantages, and often, first impressions and first products are the best.

For several years, self-storage treated RV and Vehicle spaces as a secondary market or an ‘add-on’ way to earn a little extra money. Now, we are seeing RV storage spaces becoming the least expensive space with the most significant income potential per square foot generated in this higher-valued asset and executive concierge amenity storage class. People may leave behind old furniture and boxes. But they will not leave their RV’s, boats, recreational toys, or vehicles because of their higher value to their work or leisure.

TSN: What happens when the unexpected happens?

TPP: TPP’s RV Gap Coverage is there. We are the best in the industry with claims and handling unexpected losses or damages or accidents. You can count on us.

TSN: Why RV Gap Coverage?

TPP: As the owner of an RV storage facility, you’re constantly asking yourself three questions:

- First, how can I best protect my revenue?

- Second, how can I best protect my recreational vehicle customers?

- And third, how can I best protect my reputation?

The answer to all three questions is the same: with RV Gap Coverage’s recreational vehicle protection program.

First: protecting your revenue. In a recent six-month period, one client increased their revenue by 9.5% by offering RV Gap Coverage. They generated $72,960 in additional revenue with a 75% sales penetration and ‘claims to loss ratio’ of under 5%. That’s annualized revenue of $146,000, with no upfront expense.

Revenue is king. Offering our RV Gap Coverage protection program is a perfect way to generate additional revenue without having to compete on lease pricing.

And because there are NO upfront costs with RV Gap Coverage, the revenue generated by our program falls straight to your bottom line. It’s also a great way to hedge against the likelihood of increased expenses or add ancillary products and services.

RV Gap Coverage is an easy program to implement, sell and administrate. And, you can earn as much as you want to sell. We provide you with a collection of high-quality promotional materials and live online training to promote and sell the program.

And here’s a critical point to remember. RV Gap Coverage is not an insurance product, so no state insurance license is required. You’ll never have to attend insurance licensing classes, get fingerprinted, or go through background checks. You shouldn’t have to go through that when all you want is to protect your customers and yourself.

Second, protecting your recreational vehicle customers.

What RV Gap Covers

- RV Gap Coverage Is a ‘gap’ plan that reimburses the out-of-pocket insurance deductible up to the plan limit.

- It provides up to $500 for theft or content damage for items not permanently attached to the vehicle, e.g., batteries, generators, propane tanks, both onsite and off-site.

- Covered perils include burglary, fire, explosion, vandalism, onsite accidental damage to the facility or another tenant’s property, and after-market replacement costs for stolen catalytic converter parts up to $350 per incident.

And third, protect your reputation.

We had a real-life example of a facility with a security issue that led to implementing additional precautions. A facility in CA was hit by a ring of burglars targeting catalytic converters. As reported, there is big money in stolen catalytic converters, and thieves stole parts from 32 vehicles. This was a customer service and reputation management nightmare for the owner. Managers had to deal with angry tenants and negative online reviews. Many tenants moved their RVs to other facilities. That owner lost many of those tenants because of the incident. They enhanced security at the facility, adding new cameras, and implemented our RV Gap Coverage protection program. They have replaced the lost tenants and then some. While including a protection program would not have prevented the previous burglary, it would have offset the tenant’s loss of the stolen catalytic converters avoiding challenges they faced. The facility now positions the protection program as an added level of security for their RV storage customers.

It’s not uncommon for RV owners to turn off their Collision/Comprehensive Coverage while their vehicle is being stored. But if something happens at the storage facility and their coverage isn’t activated, they’d be looking at a potentially severe loss. But RV Gap Coverage keeps them protected.

And here’s one more way RV Gap Coverages watches out for you, the facility owner. If a customer has a claim but is behind on their rent payment, they won’t receive their claim check until they’ve paid you in full for their rent.

We’d love to help you better protect your customers, your managers, and your reputation. It’s all about peace of mind.

For more information on TPP’s RV Gap Coverage, visit rvgapcoverage.com.