Written by Chris Koenig, President, Pacific Property Advisors, Inc.

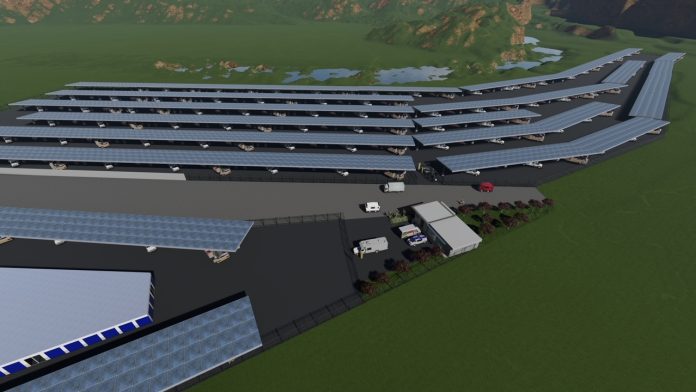

TSN – Selling Solar Power Generated From a Solar-Canopy RV and Boat Storage Facility: Part Two

Welcome to Part Two of our three-part series on the amazing benefits of solar-canopy RV and boat storage facilities. My favorite real estate owners/nvestors look at their property as an asset that has infinite potential for additional sources of revenue. This includes the office in downtown Los Angeles with four cell towers on the roof generating $20,000 a month in passive income as well as the self-storage owner charging a $15 one-time administrative fee upon move-in. Hey, why not pass along the credit card processing fee of 2.5% if consumers don’t push back? This is added revenue. This leads me to my faithful believers in the solar industry as an additional source of revenue.

On paper, in theory and environmentally, solar is amazing and should be utilized by every commercial, industrial and residential development from herewith. In practice, there are several hurdles that, unfortunately (in my opinion), preclude solar from being installed. The leaders of this excuse include: (1) “I can’t use the tax credit;” (2) “I don’t want roof penetrations;” or, (3) “Who’s going to buy the power?” All valid concerns but, as with most things, they have a potential solution.

As discussed in Part One of three, (1) the tax credit can be pawned off to a third-party; (2) the roof penetrations are a thing of past and might have been a concern by rookie-roofers new to the solar game in 2000, but is no longer an issue; and, (3) we may or may not have a solution on how to sell the power to a third party. This selling of the power is an issue because your RV and boat storage will only use roughly 40kWh (kilowatt-hours) vs. a typical RV and boat storage with solar canopy production of 2,000kWh to 4,000kWh, so roughly 2%-1% of the potential production. We need to find someone to buy this power!

DISCLAIMER: I AM NOT AN ACCOUNTANT AND YOU SHOULD DISCUSS THIS WITH YOUR ACCOUNTANT, ATTORNEY, NEIGHBOR, FAMILY FRIEND, ETC. THIS IS NOT TAX OR ACCOUNTING ADVICE.

Disclaimer Two: As discussed in Part One, there is the possibility of an additional source of revenue and incredible tax benefits by going solar on the roof. I should disclose that my opinion is that non-solar covered RV and boat storage projects still work well and can be easily a double, triple or homerun. However, solar boosts them to a grand slam!

Extensive research needs to be done by you and your solar contractor as to what entity you can sell your enormous amount of power to. For some, this is a local utility company, while for others this may be a local Amazon warehouse or several consumers of power. My favorite is selling the power to Napa Valley, California wine warehouses, which don’t want the roof penetrations (in fear of water leakage and mildew in expensive wine) that pay >$0.30/kWh for power to the local utility but would happily pay $0.20/kWh to a neighboring property for the power from its solar-carport generation. It’s a true win-win across the board and provides financial security with a 10- 15- or 20-year Power Purchase Agreement (PPA) that is bankable!

Several states across our lovely USA also have “community solar,” which allows a solar-canopy RV and boat storage project on 7th St. and Madison to sell power to the 500,000-square-foot Amazon warehouse across town on Olympic and Johnson for $0.10/kWh on a 20-year PPA.

As discussed in Part One and above, these PPAs are like cell-tower leases in that they can be added as revenue for a project and included in the valuation analysis. They can be capitalized using a cap-rate or discounted cash-flow method! A solar PPA with $400,000 in annual revenue can increase the value of a property by easily $6.7MM on a 6% cap rate. This is easy, triple-net-like revenue, which comes from the local utility or other off-taker of the solar power. As said before, each state is different.

My professional advise is to talk to as many local solar contractors and public energy providers as possible to determine if you can convert your covered storage facility to solar. I emphasize “as many” because 50 solar companies might give you 50 different interpretations on the local rules. Please do not get discouraged if you speak to 1, 2 or 10 companies and they tell you “No!” In this solar world we live in, there are always loopholes and avenues we can navigate that others are fearful of as lower-hanging fruit exists elsewhere to turn a profit. We are in this for the long haul!

My suggestion is to reach out to the local municipality and use the catch phrases “feed-in tariff” as well as “direct access” and “community solar.” I am happy to learn new buzz words that will point us (and Google) in the right direction.

The main concern for your project is providing an additional source of revenue by selling the power from the roof to someone, while renting the covered space underneath for a premium. This is our peak and #1 goal!