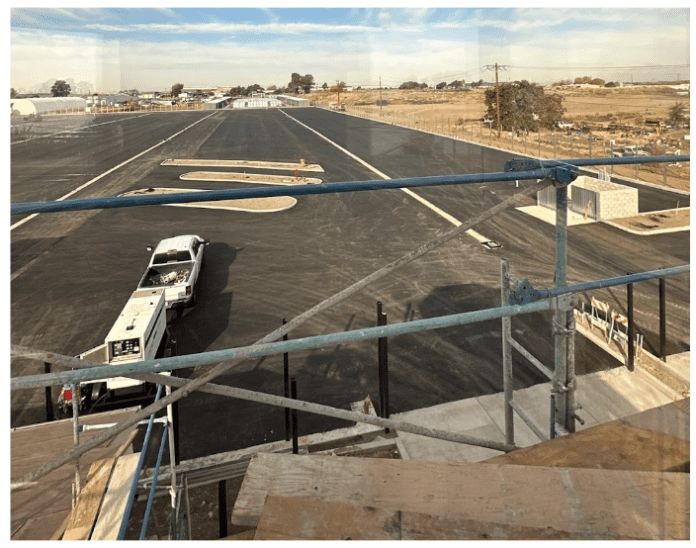

Rio Vista Executive RV & Boat Storage, a 500-unit solar-covered RV and boat storage facility under construction in Rio Vista, Calif., has received a rare, Power Purchase Agreement (PPA) from Pacific Gas & Electric (PG&E), a local utility in Northern California to sell its 3MW of solar energy for use by local residents and businesses. While the state of California is promoting and pushing for renewable energy development, there is a disconnect between renewable energy developers, the energy providers and the consumers of energy. Fortunately, the California Public Utility Commission (CPUC) has enacted certain code sections that allow small, renewable generators to sell to local utility companies at a moderate price, when coupled with new Inflation Reduction Act (IRA) tax credits make projects feasible.

Selling Renewable Energy

The deal breaker in solar RV and boat storage projects is securing an off-taker (buyer) of the power. This Rio Vista Project is 3MW AC, which is roughly the equivalent of 600 homes or small businesses. Current law in California does not allow community solar to sell to local homes/businesses, and, therefore there are limited choices for solar developers on RV and boat storage developments.

Given the small handful of PG&E Tariffs available to sell power to third parties, Rio Vista Executive Chris Koenig spent nearly 18 months pursuing an option to sell PG&E its renewable energy under a 20-year PPA. In November 2022, Rio Vista Executive secured this PPA and now can secure solar financing to finalize development of its project.

Solar Benefits

Solar is not only a tremendous benefit to the environment but, in California, it has other fringe benefits that should not be overlooked. These benefits include reduced property taxes due to the fact that solar-related costs are exempt from property tax assessments. This includes, among other things:

- Solar-canopy support structures (carports);

- Solar panels (the shade);

- Underground conduits; and,

- All other solar related costs.

This can save a project $40,000 to $80,000 a year in reduced property taxes. Financing for these projects is even more attractive since, among other things, the IRA allows for tax credit investors (or lenders, depending on the structures) to go back three years on tax returns rather than the previous one-year limitation.

Additional Revenue

Given the latest IRA tax advantages, a property owner can benefit from significantly reduced debt service payments with 40%-60% Investment Tax Credits (ITC) available. Developers can utilize these ITCs or choose to let a third-party finance company monetize the ITC in trade for a significantly lower debt payment, possibly close to a negative interest rate.

In the scenario for Rio Vista Executive, the expected revenue is roughly $350,000 annually with a debt service of approximately $300,000; for a net income on the solar system of $50,000 annually. This doesn’t include the space/tenant revenue, nor does it factor in the property tax savings of nearly $60,000 annually.

Unique Solar-Energy Buyer

After talking with nearly 100 solar developers in California, Koenig says he was told over and over again, “You can’t sell solar to (insert potential buyer); you can only offset your usage on-site.” A typical project only uses about 0.5% of the overall power generation. This was the common theme from all parties, as common as “the sky is blue,” he adds.

After extensive investigation into PG&E and CPUC codes, Koenig determined there are one or two options for selling its power to PG&E that will take the Rio Vista project to the next level–taking a double/triple project to a grand slam. With this PPA in hand, Koenig now expects to secure financing for the solar portion within the next two to three weeks.

No-Brainer

In the common event that the solar system, on its own, makes 8% to 10% cash on cash return, which even these days is so-so, says Koenig, there are significant factors that make converting a project to solar a no brainer. Aside from the property tax benefits and additional revenue sources described above, going solar or “renewable” or “green” are real buzz words that developers can use to help position projects differently from other, generic RV and boat storage projects.

Including an environmentally conscious component to a development project helps enormously when environmental aspects are evaluated (CEQA in California) including other environmental aspects. Koenig highly suggests exhausting all efforts to find an off-taker of future covered RV and boat storage project’s solar power if possible. In addition, he states, “I cannot emphasize enough to not let one, two or 10 companies deter you from finding an off-taker for your solar. These are unique and uncharted waters that are still getting sorted out by entrepreneurial minds like us. Never take ‘no’ for an answer.”