By Austin McLeod, Matthews Real Estate Investment Services

The onset of COVID-19 prompted many to reevaluate previous choices of travel and recreational activities, searching for destinations and activities that were both drivable and outdoors. As a result, the sale of RVs and boats reached record highs, leading to the need to store these vehicles skyrocketing.

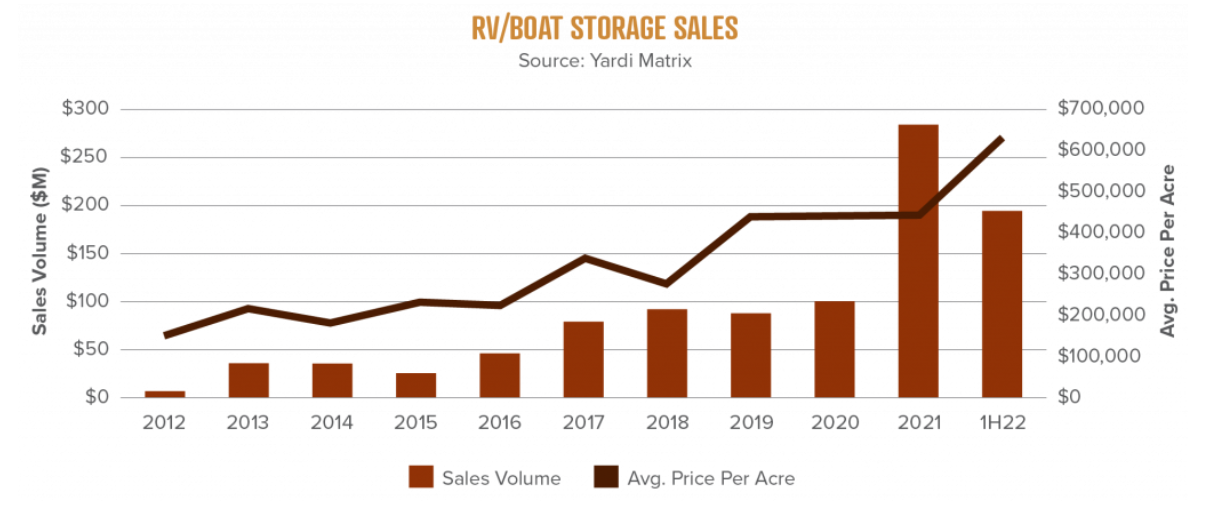

In 2021, a record number of RV and boat storage facilities were sold, totaling $285.4 million in sales volume, nearly tripling the previous high in 2020, according to YardiMatrix. Continued growth is anticipated in the United States’ RV market, which is currently valued at $55.90 billion and is expected to reach $87.98 billion by 2028, according to Global News Wire.

Boat and RV sales are expected to continue to reach record highs, reflecting the surge in RV registries and boating licenses. In the past five years, more than 2.5 million RVs and 1.6 million motorboats have been registered in the U.S.

Why Invest in Boat and RV Storage

With the influx of large water and RV sales came the need for somewhere to store them. Many HOAs forbid boats and RVs to be parked in driveways in front of homes or on the street for extended periods, pushing owners to find alternative storage options outside of neighborhoods. In fact, less than 14% of existing HOAs offer storage or parking for RVs and watercrafts in their communities, according to Mini Storage Messenger. Therefore, owners are forced to find storage facilities that house their large “toys” in close proximity. On average, RV owners use their vehicles 25 days out of the year, and boat owners operate their boats 54 days per year, leaving the remaining time in storage facilities, according to RVIA.org.

Boat/RV Storage vs. Self-Storage

There are many differences between boat and RV storage and self-storage facilities. Each has a specific clientele, infrastructure, cost, location and land requirement. When owning a boat/RV storage facility, many benefits and considerations come into play.

Benefits:

- High Demand and Low Competition: Owning an RV and boat storage facility benefits investors looking to enter the sector because demand outweighs the current supply. This market offers multiple routes of opportunity including acquiring land to restructure mom-and-pop owned properties and building facilities in areas of increased demand. Boat and RV storage facilities do not come by as often as self-storage facilities and are usually close to a lake, ocean, national park or campground.

On average, customers will travel between 20 to 50 miles to store these assets properly. Although this number may seem jarring at first, boat and RV storage owners work with higher-net-worth customers with disposable incomes. These individuals are looking to store their hobby vehicles safely and travel the extra lengths to do so.

- Long-Term Tenants: Consumers will leave their vehicle in storage for an average period of six to eight months before taking it out, creating a long-standing loyal customer base and high occupancy rates.

- Low Overhead: According to ToyStorageNation, a facility with 600 to 800 spaces may need about 15 to 20 acres of land, making densely populated areas less feasible markets for a storage facility. Although boat and RV storage facilities may require more land than traditional self-storage, they typically require a lesser expense load and boast a lower delinquency rate than self-storage. Unlike most self-storage renters, boats and RVs are of considerable value, sometimes reaching $500,000 depending on the vehicle. This often leads to less accounts receivable, since owners do not want to lose their assets.

If a customer at a boat and RV storage facility becomes delinquent and does not pay their rent, the facility can auction off their unit and all its contents.

- Increasing Rent Opportunity: Boat and RV facility customers are looking for additional features to ensure vehicle safety, accessibility, and an enjoyable experience when using their vehicles. To enhance profitability and customer experiences, owners can tap into income-producing supplementary services such as dump stations, wash stations, in-house convenience stores and 24/7 security personnel. These additional amenities allow owners to increase rents.

Although these additions may have more costs on the front end, the return on investment is plentiful. As of 2022, the boat and RV storage facilities’ average price per acre sold is $624,000, a large jump from 2021’s record level of $447,000, according to YardiMatrix.

Considerations

- Type of Storage: As an investor, there are a few options to choose from regarding boat and RV storage properties. There are fully enclosed structures that offer the most protection, overhead canopy units that offer fair protection, or just large parking spaces with zero protection. Each unit type comes with its own set of pros and cons in relation to rent rate and operating costs. It is essential to keep lot size, budget and target audience in mind when deciding which type of storage facility to invest in.

- Space: The minimum driveway width for boat and RV storage is about 50 feet wide, compared to self-storage, which is about 25 feet wide. Additionally, properties are most likely located in rural, isolated areas with more land.

- Rent: The average rent per square foot of boat and RV units is typically less than traditional self-storage. Therefore, boat and RV facilities usually sell for a lower price per square foot than self-storage facilities.

Hot-Spots:

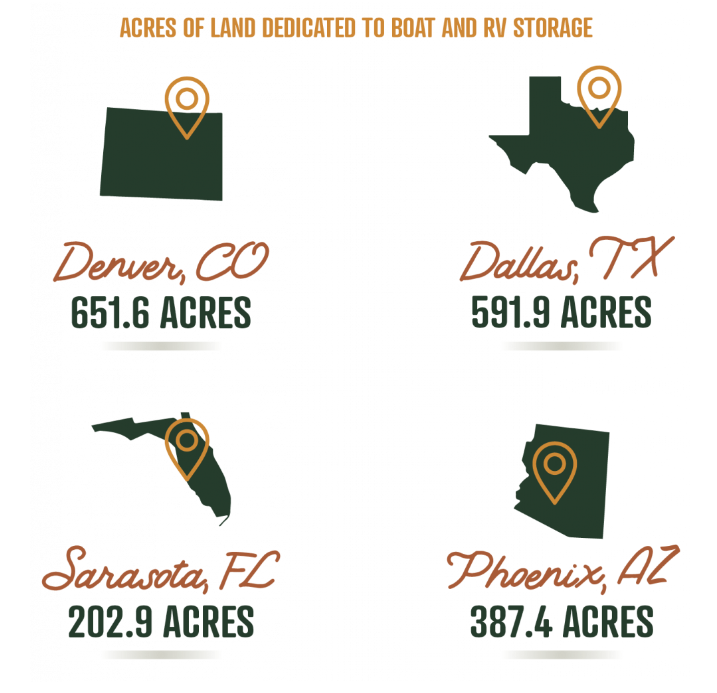

Boat and RV storage facilities are not necessities for the average consumer. As a result of their niche clientele, these facilities are in specific areas, typically nearby national parks, campgrounds and lakes. Here are the largest markets for boat and RV storage facilities:

Looking to the Future:

The future for boat and RV storage is filled with immense opportunity. There are currently 786 completed boat and RV storage properties in the United States, totaling 6,850 acres of land and another 35 facilities in the pipeline, according to YardiMatrix’s database.

Since traditional self-storage facilities do not have the space or need in some cases to implement large vehicular storage, there is a gap in the market where boat and RV storage comes into play. More and more investors are starting to recognize the opportunity as demand and prices for these investment properties have increased.

Overall, the pandemic resulted in a significant increase in boats and RVs purchased, causing most of the boat and RV storage facilities to be close to fully occupancy. Due to increased demand caused by high occupancy, boat and RV storage development will continue to become more popular, and demand on the acquisition side will grow.

Austin McLeod serves as Vice President of Matthews Self-Storage division. Having sold more than two million rentable square feet of storage in 11 different states, he works with a wide range of clients, including private investors, developers, private equity funds and the industry’s largest institutional investment firms. His extensive transaction experience and comprehensive knowledge of the self-storage market have helped Austin form strong relationships in the industry. Ultimately, Austin leverages his unrelenting work ethic, market knowledge and Matthews technology to achieve his client’s goals.

Matthews Real Estate Investment Services™, a commercial real estate investment services and technology firm, holds recognition as an industry leader in investment sales, leasing and debt and structured finance. Matthews delivers superior results through the firm’s industry-reversed work ethic, unique culture, collaboration and advanced technology. Since 2015, Matthews has experienced unprecedented growth adding over 500 real estate professionals to serve clients. Founded in El Segundo, Calif., and strategically positioned in 15 offices across the United States, Matthews continues to expand into new markets.

Matthews redefines what clients expect by accelerating the evolution of how the commercial real estate industry services clients through technology. By leveraging technology and industry-leading resources, Matthews is committed to growing and preserving client wealth and adding value to their investment strategy. For more information, visit matthews.com.