Bishesh Shrestha is vice-president of self-storage financing with Live Oak Bank. He is a dedicated lender in the self-storage space and has been working in the self-storage industry since 2016. As a senior loan officer, he is responsible for evaluating, qualifying, and structuring, self-storage deals. Bishesh works with borrowers across the country to secure self-storage financing using various loan products (SBA, USDA, and Conventional Bank debt).

Bishesh was born and raised in Kathmandu, Nepal. After attending grade school in India, he was accepted to Miami University in Oxford, Ohio, where he earned a degree in foreign affairs. Bishesh later completed his master’s degree at Elon University earning an MBA. He joined Live Oak Bank in 2013. Bishesh started in the Business Advisory Group and was quickly promoted to an underwriter, then moving to an underwriter team lead for the healthcare vertical. As a loan officer, he is responsible for evaluating, structuring and packaging SBA loans for the industry. To learn more about Bishesh and Live Oak Bank, visit www.liveoakbank.com/self-storage.

Toy Storage Nation is grateful to have a few moments with Bishesh to provide insights into the lending process for self-storage properties with a specific focus on RV and boat storage.

Will an industry newcomer, without vehicle-storage experience, have a more difficult time finding a lender? If so, what will they have to provide to give lenders the confidence needed to move forward on a loan?

Lenders can be picky about vehicle storage and even self storage. It is imperative that an individual connect with a lender that has provided financing in these asset classes. Lender’s who specialize in this asset class will be able to understand the transaction better and the individual has a higher likelihood of success. A newcomer to the industry will have to show transferable skills when it comes to taking on this new industry.

Vehicle storage as well as self storage is not a highly complex business, but a potential business owner must show a detailed plan for success and their capability to run a business. Transferable skills in this case will be skills that an individual has gained by operating other businesses, working in a management environment (in their current jobs) etc., that can be applied to storage.

Is the loan process the same for traditional storage operators? Do self-storage operators expanding into RV and boat storage have an advantage, thus enabling them to move through the process more quickly?

The loan process is the same for vehicle and regular storage. Most lenders will look at cashflow and valuation prior to making a decision. Existing self-storage operators expanding in the vehicle-storage space will have an advantage since they will have experience in the space.

How long does the process take from initial phone call to loan disbursement? Can you briefly summarize if there are any steps that developers can take to streamline the process?

Loan processing time depends on the complexity of the transaction. Most storage acquisition transactions can be completed within 45-60 days. Construction loan process can be anywhere between 60-90 days depending on when the borrowers can provide the documents and information requested by the bank. Connect with the lender early to familiarize yourself with what kind of documents will be needed. If there are third-party reports needed for underwriting, it is important to jump on those to prevent any delays in the loan process.

What are questions that developers should be asking of lenders to ensure they’re finding the most qualified/best fit for their loan?

All loan products are not made the same. Every loan product comes with its own set of Pros and Cons for a prospect. Every individual needs to convey their project details, their financial standing and their risk profile so the lender can provide them loan options that will be the best fit. Interest rate, recourse, leverage/down payments and working capital are few of the items we discuss on a regular basis. There is no one loan solution for everyone, but everyone will have access to a particular loan.

What is Live Oak Bank’s relationship with the storage industry? (In other words, does the bank have loans specific for storage operators, how long have they been in this industry, any features of your loan program that are of particular interest to storage developers?

Live Oak Bank is different from most other banks. Live Oak is headquartered in Wilmington, North Carolina; we do not have any branches, however, we do lend nationwide. We are essentially a commercial lender with specific industry focus. We currently lend in 30+ different industries. Although the industries in which we lend are very different, they have certain characteristics in common—low default rates, strong, recession-resistant cash flows, and high barriers to entry.

When self-storage became a new lending specialty at Live Oak in 2015, we built a lending team dedicated to this industry. This team has a laser focus in this industry and all we analyze is storage acquisitions, expansions, refinances and new construction projects. Our knowledge and industry experience helps us understand loan requests so that we can process them more efficiently.

Due to our laser focus on self-storage financing, we view loan requests as potential 25-year partnerships and are committed to being a resource to our customers throughout the loan application process and beyond. Live Oak Bank is the largest SBA lender in the country. We are preferred lenders with the SBA so all approvals on the 7A program are done in house. Live Oak has won the Inside Self Storage’s “Best Lender” award for seven years running. The self-storage team at Live Oak has originated over $1B of self-storage loans in the last eight years. The loan products available to potential clients include SBA 7a, SBA 504, USDA and conventional loans.

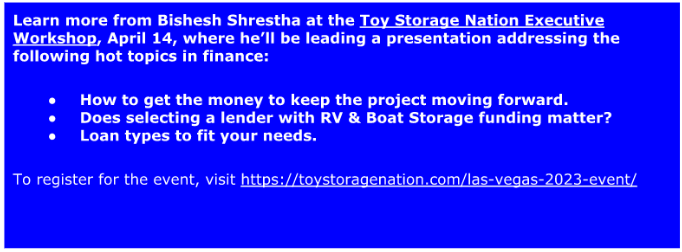

To connect with Bishesh Shrestha at Live Oak Bank, and to learn more about the loan process for funding an RV, boat or self-storage facility, visit www.liveoakbank.com/self-storage.