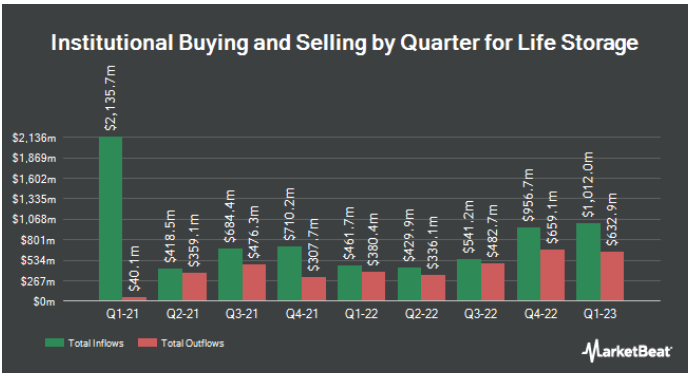

Vanguard Personalized Indexing Management LLC trimmed its position in Life Storage Inc. by 34.7% in the fourth quarter, according to its most recent disclosure with the SEC. The institutional investor owned 3,710 shares of the real estate investment trust’s stock after selling 1,972 shares during the period. Vanguard Personalized Indexing Management LLC’s holdings in Life Storage were worth $365,000 at the end of the most recent reporting period.

Life Storage is a real estate investment trust, which engages in the acquisition, ownership and management of self-storage properties. It offers commercial, vehicle storage (including RV and boat storage) and wine storage services.

A number of other hedge funds have also bought and sold shares of LSI. Brown Brothers Harriman & Co. acquired a new stake in Life Storage during the first quarter worth about $32,000. Raleigh Capital Management Inc. lifted its position in Life Storage by 148.5% in the fourth quarter. Raleigh Capital Management Inc. now owns 333 shares of the real estate investment trust’s stock worth $33,000 after purchasing an additional 199 shares during the period.

Point72 Hong Kong Ltd bought a new position in Life Storage during the 1st quarter valued at $38,000. Huntington National Bank increased its position in shares of Life Storage by 71.3% during the 3rd quarter. Huntington National Bank now owns 454 shares of the real estate investment trust’s stock valued at $50,000 after purchasing an additional 189 shares during the period. Finally, Accurate Wealth Management LLC bought a new stake in shares of Life Storage in the 4th quarter worth $53,000. 89.61% of the stock is currently owned by institutional investors and hedge funds.

Life Storage Trading Up 0.7 %

LSI stock opened at $129.48 on Monday. Life Storage, Inc. has a 1-year low of $94.02 and a 1-year high of $146.66. The company has a current ratio of 0.42, a quick ratio of 0.42 and a debt-to-equity ratio of 0.95. The business’s 50 day moving average is $133.51 and its 200-day moving average is $118.10. The firm has a market cap of $11.02 billion, a P/E ratio of 30.04 and a beta of 0.65.

Life Storage Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, April 26th. Shareholders of record on Friday, April 14th, were given a $1.20 dividend. This represents a $4.80 dividend on an annualized basis and a yield of 3.71%. The ex-dividend date of this dividend was Thursday, April 13th. Life Storage’s dividend payout ratio (DPR) is 111.37%.

Analyst Ratings Changes

A number of equities research analysts have weighed in on the stock. Raymond James upped their price target on shares of Life Storage from $140.00 to $145.00 and gave the company an “outperform” rating in a report on Tuesday, April 4th. Citigroup cut shares of Life Storage from a “buy” rating to a “neutral” rating and set a $126.00 price objective on the stock. in a research report on Wednesday, February 8th. Truist Financial increased their target price on Life Storage from $115.00 to $120.00 and gave the company a “hold” rating in a report on Wednesday, March 8th. Wolfe Research lowered Life Storage from an “outperform” rating to a “market perform” rating in a research report on Wednesday, April 12th. Finally, KeyCorp boosted their price objective on shares of Life Storage from $136.00 to $154.00 and gave the company an “overweight” rating in a research report on Wednesday, April 5th. Eight research analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat.com, Life Storage currently has an average rating of “Hold” and an average target price of $128.89.

The company was founded by Robert J. Attea, David L. Rogers, Kenneth F. Myszka, and Charles E. Lannon in 1982 and is headquartered in Buffalo, NY.

To receive a daily summary of latest news analysts’ ratings for Life Storage and related companies sign up for the MarketBeat.com’s FREE daily email newsletter.