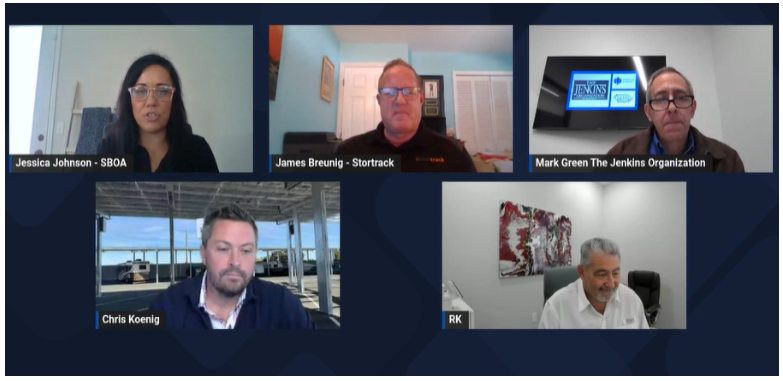

The Storage Business Owners Alliance (SBOA) conducted an illuminating Fall Virtual Summit for the self-storage players, Nov. 1-2, closing out the event with a dynamic session dedicated to RV and boat storage. In short, the session depicted a vibrant future for this emerging industry niche.

“I can honestly say that RV and boat storage is truly the most exciting storage component of the self-storage industry,” said RK Kliebenstein, longtime industry consultant. “RV and boat storage today is where the self-storage industry was in the 1990s and the beginning of the 2000s.”

The sentiment resonated with all members of the panel. “It’s in its infancy and growing fast,” reiterated Mark Green, representing the Jenkins Organization, an integrated real estate company that recently pivoted into the toy storage industry.

Evidence that this storage segment will continue flourishing, Kliebenstein said, is that rec-vehicle dealerships are packed full with RVs and boats; consumers are purchasing, but when they do, they face a ubiquitous problem. “The point being that there is a great demand for storage, but there is dearth in facilities to house them,” he said, adding that he reviews dealer supply and RV and boat shipments when conducting feasibility studies.

One of the greatest challenges confronting developers and investors interested in staking their claim in RV and boat storage is the lack of data pinpointing how many facilities currently exist and how many are in the pipeline. Several data analytic platforms have emerged in recent years, building upon their experience compiling self-storage data, but the resulting numbers for RV and boat storage vary so widely that developers are left scratching their heads.

“It’s really difficult to collect appropriate data for younger industries,” said Kliebenstein, “because it’s all collected manually, in silos. All data providers are doing the very best they can with the best info they have, but there will always be differences. It’s not wrong, but you need to triangulate your data and take it from several sources.”

James Breunig, of StorTrack, one of the prominent data analytics platforms for self-storage as well as RV and boat storage, fully agreed with Kliebenstein’s perspective. “Boat and RV storage is the big growth in the industry right now, but everybody collects data a little differently.”

StorTrack leans on tried-and-true forms of data collection, Breunig said, including county data, websites, rental rates and other radius demographics, all of which have grounded the self-storage industry. Complicating the issue, though, is that great variations exist in storage models. “We’re tracking 4,700 dedicated facilities and 19,000 hybrids,” he said.

Over the past several years, more and more traditional storage operators have leaned into hybrid models, expanding to include RV and boat parking on their existing lots. The level of sophistication varies from site to site, said Breunig. “It will be interesting to see, because the majority out there are dirt lots with chain-link fences. When you see higher developers come in–incorporating enclosed and covered spaces–you see a jump in rents.”

According to Chris Koenig of Kingsland Properties, developers interested in long-term RV and boat storage success will need to gravitate toward building executive Class A facilities. Koenig, who serves as Toy Storage Nation’s Advisory Board Chair, owns and operates self-storage, and recently made the jump into toy storage.

Class A facilities, according to Toy Storage Nation, share four things in common: They are fully paved and fenced, offer canopied-covered or fully enclosed spaces, and have a security gate at the entrance/exit point. Many go far beyond incorporating these elements and numerous other luxury amenities to attract–and retain–customers.

“I’m all in on the Class A RV and boat storage business,” said Koenig, who previously worked in commercial real estate before storage. His first toy storage facility recently opened in Rio Vista, Calif., not far from other facilities falling short of his standards of security and customer amenities. “There are two or three competitors about a half-mile from my site,” he said. “I had a few of their tenants move in the second day that we opened.”

Tenants can be swayed by price, he stated, but security will win over less sophisticated facilities, especially as the industry evolves. In addition to an advanced entry gate access system and security cameras placed throughout the Rio Vista facility, “I have a 10-foot-tall solid metal fence,” Koenig said. “If someone wants to get on the property, it’s going to be a big challenge, and this helps me to position my facility better.”

“For the most part, everyone agrees that the Boat and RV storage industry is bullish, for a litany of reasons,” concluded Kliebenstein, “but it really is a supply issue. Supply hasn’t caught up with demand.”

“Look back over time,” advised Bruenig. “Self-storage has been spiking up and down, but boat and RV has been a steady eddy.”

To learn more about SBOA resources, including the recent virtual event, visit the organization’s website.

Interested in staking your claim in the RV and boat storage industry?

To learn more about developing, operating and investing in RV and boat storage, register for the upcoming Toy Storage Nation Executive RV and Boat Storage Workshop in Fort Myers, Fla., Dec. 1, 2023. This exclusive, one-day workshop provides the A-to-Z compendium of RV and boat storage knowledge you need to accelerate your success in this rapidly growing, prosperous industry. Register today.