By Jeff Adler

Storage demand continues to face headwinds from housing market

Excerpts from the newest Yardi Matrix report

The self-storage industry continues to be impacted by the housing market. Rising housing costs and incomes that have not kept pace have resulted in one of the most unaffordable housing markets in the past 30 years, stifling home sales. With housing demand a key storage demand driver, the resulting housing slowdown is dampening storage occupancy and weighing down street rates. Occupancy is now back where it was pre-COVID, falling even lower in some Sun Belt markets that had previously benefited from COVID-era migration.

While nationally asking rate growth has not gotten worse over the past six months, street rates remain negative on an annual and sequential basis. Supply under construction has stayed steady, but new starts are beginning to slow and the time it takes to move from one stage of development to the next has increased, indicating that more developers are delaying new projects. However, some are optimistic that as new home sales eventually find a bottom and new storage development slows, we will begin seeing improvements in storage occupancy and street rates.

Street rates stay down year-over-year in most metros

- Annual street rate growth stayed negative in November. The average annualized same store asking rent per square foot was $16.57 nationwide for the combined mix of unit sizes and types. This is a 4.2% decrease compared to the national average of $17.40 recorded in November 2022.

- Street rate growth also continued to be negative year-over-year in the majority of Yardi Matrix’s top metros in November. Combined same-store rates for non-climate-controlled (NCC) units fell in all but one of the top metros on an annual basis, while asking rates for same-store climate-controlled (CC) units decreased in all of the top metros.

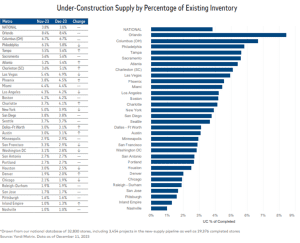

- Nationally, Yardi Matrix tracks a total of 5,028 self-storage properties in various stages of development, including 883 under construction, 1,940 planned, 631 prospective, 1,489 abandoned and 85 deferred properties. The share of projects (net rentable square feet) under construction nationwide was equivalent to 3.8% of existing stock in November.

- Yardi Matrix also maintains operational profiles for 29,376 completed self-storage facilities in the U.S., bringing the total data set to 34,404. Yardi announced the release of the Clarksville storage market, which is now available to Yardi Matrix customers.

Construction activity remains stable, but number of abandoned projects increases

- The national new-supply pipeline was unchanged month-over-month in November, with inventory under construction accounting for 3.8% of completed net rentable square feet (NRSF). The storage under-construction pipeline has remained relatively stable nationwide. However, the number of development projects abandoned across the nation has been slowly increasing towards the end of the year. The average amount of time it takes for a project to move from the planned to the under-construction phase has consistently increased, more than doubling the past few years, suggesting projects are becoming less feasible and less likely to get built. As a result, the number of completions will eventually begin to slow.

- Construction activity increased the most in Charleston. It was up 150 basis points month-over-month in November and a substantial 3.8% over November 2022, when inventory under construction accounted for 1.3% of completed NRSF. However, due to a relatively low amount of supply in lease-up and continued strong demand, the market should be able to absorb the new supply with moderate impact on rate growth.

Click here for the full report.

Jeff Adler is vice president and general manager of Yardi Matrix Self Storage, providers of accurate data on storage facilities in 134 markets covering more than 30,000+ properties nationwide. Learn more at yardimatrix.com/storage.