The self storage market is achieving stability after an 18-month slowdown, the latest Self Storage National Report from Yardi® Matrix shows.

Annual street rate growth was still negative as of December. The average annualized same-store asking rent per square foot for the combined mix of unit sizes and types reached an average of $16.57 nationally last month, a 2.7 percent decrease on a year-over-year (YoY) basis.

Nearly all top metros had a negative street rate on an annual basis in December. Combined same-store rates for non-climate-controlled and climate-controlled units decreased YoY in all but one of the top metros tracked by Yardi Matrix.

“New supply is a concern in certain markets but overall new supply in the top markets is expected to drop in 2024 as construction lending has dried up in the face of declining street rates, slower lease up pace and higher interest rates,” say Matrix analysts.

Self-storage is dependent on the housing market for demand and slowing home sales activity and fewer moves have had a significant impact. If the national housing market improves, the outlook for storage will quickly look up.

Across the U.S.,Yardi Matrix tracks a total of 5,073 self-storage properties in various stages of development, including 871 under construction, 1,980 planned, 621 prospective, 1,510 abandoned and 91 deferred properties. Yardi Matrix also maintains operational profiles for 29,745 completed self-storage facilities, bringing the total data set to 34,818.

New Supply Update

Development activity faces challenges, but construction pipeline remains steady:

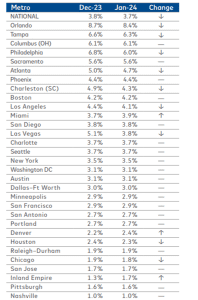

■ The national new-supply pipeline contracted 10 basis points month-over-month in January, with inventory under construction accounting for 3.7% of completed net rentable square feet (NRSF). The national under-construction pipeline has remained relatively stable over the past few months, partly due to projects taking longer to complete. In addition, storage development faces challenges that will likely impact activity in 2024. Declining street rates, a slower lease-up pace and the challenging lending environment are all factors expected to have an impact on the amount of new supply in coming years.

■ Roughly one-third of the top metros saw a decrease in their construction pipelines month-overmonth, while 19 saw their pipelines unchanged on a monthly basis.

■ The Inland Empire was one of the only three top metros to see an increase in their under-construction pipelines month-over-month. However, despite an increase, the under-construction pipeline in the Inland Empire remains among the smallest, with inventory under construction equal to 1.7% of existing NRSF.

Under-Construction Supply by Percentage of Existing Inventory

Click here to read the full report.

Yardi Matrix offers a comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers-multifamily, student housing, vacant land, industrial, office, retail and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

About Yardi

Yardi® develops industry-leading software for all types and sizes of real estate companies across the world. With over 9,000 employees, Yardi is working with our clients to drive significant innovation in the real estate industry. For more information, visit yardi.com.