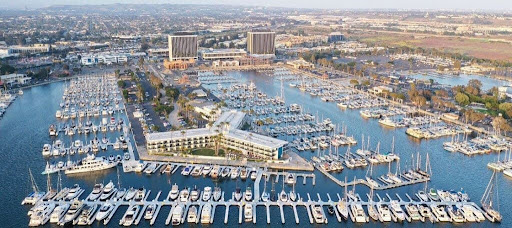

With investment support from Centerbridge Partners, Suntex is targeting more new marina acquisitions. Photo courtesy Suntex Marinas

Suntex Marina Investors LLC, the largest standalone marina owner in the United

According to the release, the funds will be used to support new acquisitions and capital improvements at newly acquired facilities, as well as for several development projects across the United States. The day-to-day operations of the joint venture will be managed by the Dallas-based Suntex, for which it will receive customary fees. The transaction further expands Suntex’s partnership with Centerbridge, which first invested in the company in 2021. In connection with the transaction, the venture also closed on a revolving credit facility of up to $600 million, which was led by Wells Fargo Bank and included Bank of America, Truist Bank, BMO Bank and First Horizon Bank.

“We’re thrilled to close on this joint venture to usher in new growth for Suntex Marinas,” said Bryan Redmond, the CEO of Suntex Marinas, which offers a world-class hospitality experience built around a community of boat owners, boat enthusiasts and those inspired by the water. “While our team continues to increase our interest in new acquisitions, a portion of these funds are going to be dedicated toward re-development and enhancement of new marinas as well. We have an incredible opportunity to further grow our network from coast to coast and improve upon the Suntex experience. We are confident that our guests will enjoy what we have in store.”

Redmond added that Suntex is committed to building on the legacies created by the founders of its acquired properties and has a long track record of working with its marina partners to become even greater contributors to their respective communities.

“The marina industry has shown consistently strong fundamentals for many years, as enthusiasts have invested in more and bigger boats while the availability of high-quality marinas and boat storage remains scarce,” said William Rahm, chairman of Suntex Marinas and global head of real estate for Centerbridge Partners. “Bryan and the Suntex team have a demonstrated track record of acquiring quality properties, enhancing operations for customers and adding value through accretive capital investments. We’re thrilled to expand our partnership.”

Matt Dabrowski, a senior managing director for Centerbridge Partners said he’s witnessed firsthand the Suntex team’s ability to deliver exceptional experiences for customers and significant returns for investors.

“Suntex is extremely well positioned to capitalize on tailwinds in the marina and broader leisure and storage markets, and we look forward to building on our partnership to bring the company’s best-in-class model to even more marinas across the U.S.,” Dabrowski added.

Since 2021, Suntex has continued to strategically grow its portfolio of marinas in high-growth coastal and inland markets, providing a best-in-class storage, hospitality and guest experience and having a positive impact in local communities across the country. The Suntex portfolio includes marinas located in Arizona, California, Florida, Georgia, Illinois, Iowa, Kentucky, Maryland, Missouri, New Jersey, New York, Oklahoma, Texas, Tennessee and Virginia.